Credit Union Board Modernization Act Passes Unanimously

Bill reduces credit union board burden by changing meeting requirements.

Last night, the bipartisan Credit Union Board Modernization Act, which Rep. Bill Huizenga introduced last week, passed via voice vote in the U.S. House of Representatives. To view House floor discussion on the bill and the vote click here.

The legislation makes a very simple change to the Federal Credit Union Act, allowing federal credit union boards to meet a minimum of six times a year rather than the 12 times per year they are currently required to meet.

“The Credit Union Board Modernization Act is a welcome change to our board operations. The current board requirements place an undue burden on credit unions, especially smaller organizations with fewer employees and resources. If passed into law, federal credit unions could spend more time serving the needs of their members and community,” said Michigan Credit Union League CEO Patty Corkery.

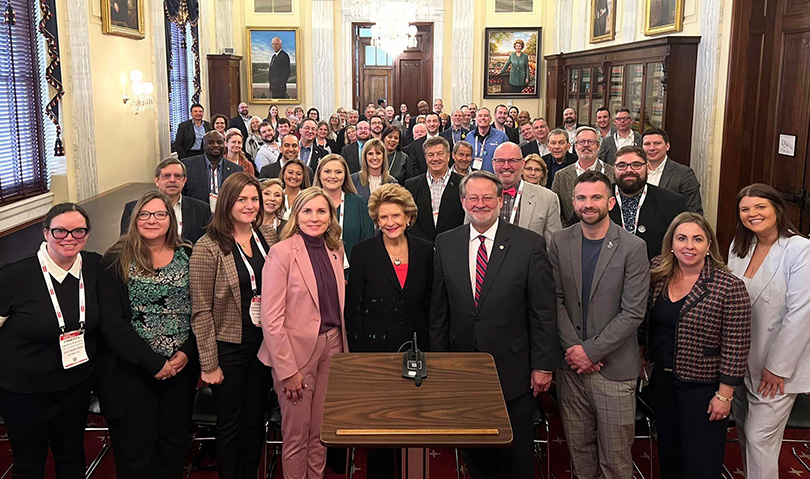

The bill was introduced in conjunction with the 2022 CUNA Governmental Affairs Conference during the 117th Congress, and passed the House with more than 100 co-sponsors. However, the bill did not pass the Senate in 2022 and expired at the end of the year.

“We are extremely pleased to have Rep. Bill Huizenga (R-MI-4) serve as a lead sponsor of the legislation. As a longtime credit union supporter, he understands the importance of removing unnecessary and burdensome requirements on credit unions. I applaud our MCUL and CUNA advocacy teams for their hard work as well as our Michigan credit union advocates who recognize the importance of meeting and working with our representatives to make change," continued Corkery. “Alongside Rep. Huizenga’s leadership, I want to thank Congressman Dan Kildee, Rep. Hillary Scholten, Rep. Lisa McClain and Rep Tim Walberg for co-sponsoring the bill which was introduced late last week and fast tracked to the House floor.”

Importantly, the bill does not apply to de novo credit unions in their first five years. Furthermore, this bill would only apply to credit unions with a CAMELS composite rating of 1 or 2 in addition to a management rating of 1 or 2 until they are able to stabilize operations, at which point they can meet bimonthly if they so choose.

“Thank you to the House members for taking up and voting to advance this bipartisan, common-sense legislation that would help free up credit union time and resources to focus on members and their needs,” said CUNA President/CEO Jim Nussle. “CUNA, Leagues, and credit unions also thank Reps. Vargas and Huizenga for moving quickly to introduce this bill in the new Congress, and we look forward to further engagement with the Senate to get this bill across the finish line.”